Dear Consultant,

I work at a non-profit organization that works with an at-risk community of teenagers. Over the last four years we’ve been helping our clients sell artwork through an online store to raise money for a number of our initiatives. Recently, one of our funding agencies has told us that they would be willing to offer us funding if we decide to turn the online art sales into a “social enterprise.” What exactly does that mean? Isn’t that what we’ve already been doing?

A social enterprise is a business initiative that derives most of its funding from the sales of products or services and where the business operates with the intent to create social value, not just profit.

Social Enterprise can mean a variety of things depending on the situation. Many people in the for-profit sector view social enterprise in terms of corporate social responsibility initiatives, including philanthropy and community engagement projects. Others in the non-profit sector think about social enterprise simply as earning money from people by selling products or services. But a fairly all-encompassing definition of social enterprise can be succinctly stated: a social enterprise is a business initiative that derives most of its funding from the sales of products or services and where the business operates with the intent to create social value, not just profit.

To be clear, a social enterprise can be a for-profit organization but it doesn’t necessarily need to be. Many non-profits seek to make money from the good work that they do, to diversify their sources of revenue away from donations and grants. There is a growing group of non-profit organizations who recognize that some or all of their operations can be sold to some kind of target market in a way that is competitive with other businesses. Generating revenue in this way offers a degree of financial self-sufficiency that many non-profits are not used to. Similarly, businesses in the for-profit sector frequently create value for their customers, which is why their customers purchase their products and services. The difference between a social enterprise and a regular business is that a social enterprise also creates social value.

Creating social value refers to helping groups that are marginalized, underprivileged or don’t have a strong voice for self-advocacy

So what is social value? Creating social value really comes down to explicitly trying to helping people in need. Sure a tax accountant helps her clients who are in need of having their tax returns filed, but that is not what we’re talking about here. Creating social value refers to helping groups that are marginalized, underprivileged or don’t have a strong voice for self-advocacy. This includes environmental issues, as many environmental issues are an antecedent for social problems including drought, disease and natural disasters.

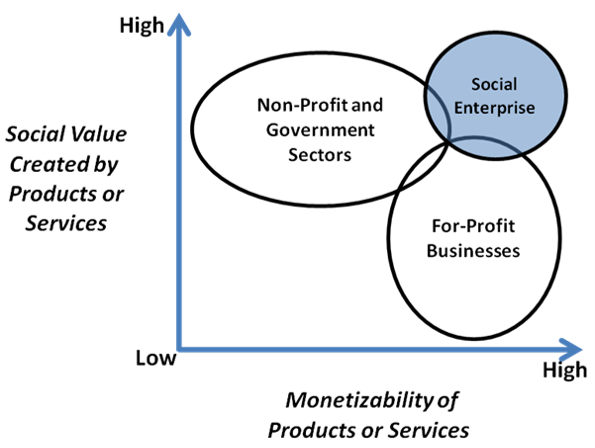

Here is a quick way to visualize how social enterprises fit into the traditional sectors that we usually think about.

A social enterprise is frequently competing with both the non-profit and government sectors, as well as the for-profit sector

A key thing to think about in this diagram is that the sectors overlap. A social enterprise is frequently competing with non-profit and government organizations that are trying to create social value for the public good, but because a social enterprise is also trying to make money from their products or services, they are often competing directly with other for-profit businesses. Monetizability refers to the likelihood of an organization to make money from a product or service, so highly monetizable products or services are frequently already highly sought after by the for-profit sector.

In your case, selling art online would be a social enterprise if you’re able to cover your costs and if you’re creating social value for your teenage clients. If after careful consideration of all of the expenses related to your art sales, including hours of effort of salaried workers, the revenue is higher than your expenses or if you have a plan to increase your revenue before taking too much of a loss, then you’re successfully operating a social enterprise. This is an entrepreneurial pursuit that involves someone championing the social enterprise as though they are an entrepreneur.